- cross-posted to:

- hackernews@lemmy.bestiver.se

- cross-posted to:

- hackernews@lemmy.bestiver.se

No, but the companies using it should.

Companies:

I’m honestly fine with companies not paying taxes so long as their profits are being spent on people in lower tax brackets.

Current tax structure makes it easy for the company to just give all their profits to their executives.

70% tax on income over $1 million. Go back to a progressive tax structure for company profits. Not sure why my local donut shop is paying the same rate as Microsoft.

But corporations are people, and people pay taxes. So yes, you will be doing that here.

And those hosting it.

Tax wealth, not work

Tax productivity, not work. Worker productivity has skyrocketed in the past few decades, but taxes have remained constant. So the rich have been able to extract increasing amounts of productivity, while paying proportionally less and less in taxes. Meanwhile, worker wages have remained stagnant, meaning their productivity has gone up but they’re still being paid (and taxed) the same.

Wealth taxes should still absolutely be a thing, but they should be entirely divorced from a work (productivity) tax.

That sounds great, but how would you objectively quantify productivity

How much did a company spend to product the widget?

How much is the widget worth?

The difference of those two is productivity

Tax wealth.

Tax land in particular. Can’t hide land easily from tax office.

good luck, churches don’t even pay taxes

But they’re charities that are not for profit…

HAHAHAHAHAHAHAHAHA … AAAAAAHAHAHAHAHAHAHAHAHA

The answer to this post, and almost everything, is to tax the wealthy.

AI is not ruining anything. The people in control of it are.

The answer to this post, and almost everything, is to tax the wealthy. AI is not ruining anything. The people in control of it are.

This is the correct take, right here. Per the article, ““The trend toward automation and AI could lead to a decrease in tax revenues. In the United States, for example, about 85% of federal tax revenue comes from labor income, says Sanjay Patnaik, director of the Center for Regulation and Markets at the Brookings Institution,” It’s the working plebs that are carrying the majority of the tax burden.

The rich can pay there fair share, or we can grind them up and feed the slush into a reverse osmosis machine during the water wars.

Because AI is a disruptive technology we should require 40% of gross profits be put into a fund to address its negative externalities.

Joke’s on you.

They don’t actually make any money. Not unless their a monopoly that’s captured regulators anyway.

Gross profits, that way they are even more fucked. Can’t make it profitable? I guess it wasn’t meant to be.

You mean gross revenue?

That would be even more brutal, but sure I could agree to that. Then you could talk them down to gross profit so they feel like they are getting something.

Externalities? I thought Trump was getting rid of those? ;)

Better yet: nationalize the AI companies. Make AI like water supply or fire service - a public utility. My government is VERY far from perfect, but even a country with any semblance of democracy has a better chance of making AI safe and useful to all than a greedy corporation. That way the training data and model parameters can be opened to public scrutiny.

I definitely want my complete incorruptible government to be in charge of the training and maintenance of the national knowledge repository, this sounds like a great idea with no chance of negative results.

At least Google just wants to steal and sell your data. Trump actively wants you to suffer.

It needs a 900% tarrif on all good. That will surely fix the economy

More tariffs! Lol

Why should AI have to pay taxes when we have an ever increasing pool of poors, thanks in large part to AI taking their jobs, to increase the taxes on… in order to fund AI and to give tax breaks to the trillionaires?

and because there is inevitably going to be someone who fails to understand sarcasm, the heaviest of /s

AI companies: “no”

When computers replaced people are computers paying taxes.

If AI “destroys” jobs, then AI should not only pay taxes, but also contribute to health insurance, unemployment insurance and pension schemes. It doesn’t matter who ultimately pays. However, I would hold employers accountable, because they are the ones who are laying off employees in favour of AI.

Of course it should. An industry run by AI, still needs roads and other public goods. Furthermore, the taxes can go towards UBI, allowing people to help guide the economy with their dollars and to ensure their personal wellbeing.

The big question is when do we remove human CEOs, and use their incomes for the common good?

No, it shouldn’t. The same way as factory machines don’t pay it.

They kinda do via taxes that are calculated based on the companies inventory value.

Machines are capital, inventory is stock. Neither are subject to tax under IFRS as far as I’m aware?

Not in all jurisdictions.

I agree. Workers shouldn’t pay taxes, same way as the other machinery.

AI shouldn’t pay taxes, but the companies making them should

Not an expert at all, but I think to an extent this already happens with the current system in most countries, and it would probably need to be done much more now. Not that Automation pays more taxes, but that having employees generally qualifies companies for tax breaks.

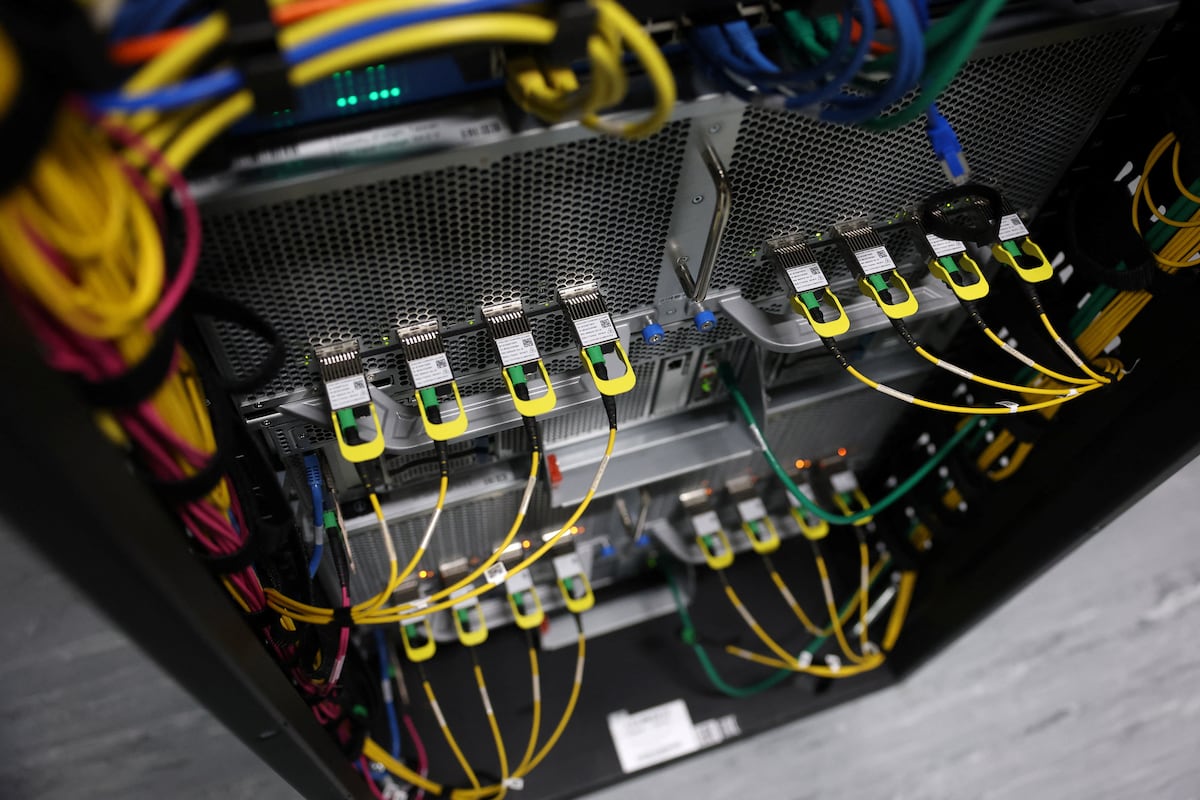

For instance, when Amazon said “we’re going to open a new HQ”, Cities and States tripped over themselves to try and give them the largest tax breaks. But that was under the assumption that the HQ would give jobs to tens of thousand of people, not to 5 data scientist and a massive, energy-hungry data center.

Seizing the means of production means pretty much exactly this, yes.

This kind of anthropomorphisation is bad, it shows a lack of understanding of the technology, it’s a terrible idea.

I think we should just let the billionaires have all of it, they seem to be the ones that need it the most.

To each according to the size of his greed.